Description

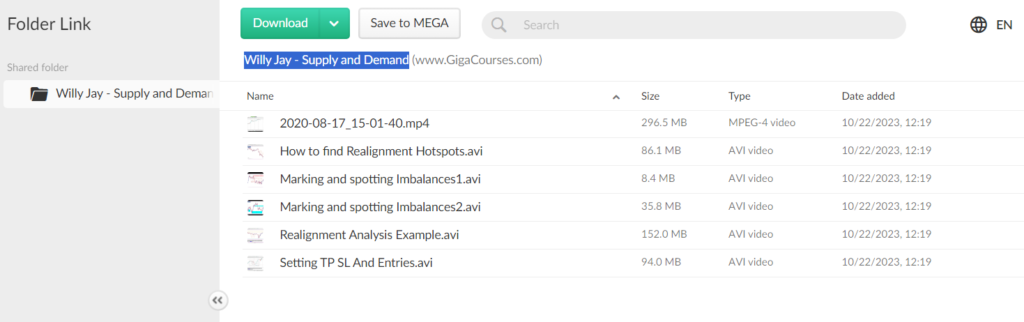

Download Proof | Willy Jay – Supply and Demand (672.7 MB)

![]()

Willy Jay – Supply and Demand

Unlocking Low-Risk, High-Reward Trading at Market Turning Points: A Different Perspective

Introduction: Challenging Conventional Wisdom

In the vast landscape of Forex trading, many mentors and institutions emphasize lagging indicators and chart patterns. However, a distinct approach, often considered the “expensive truth,” diverges from the norm. Rooted in Wall Street wisdom, this approach focuses on low-risk, high-reward trading precisely at market turning points. Contrary to the common practice of following trends blindly, this methodology taps into the psychology of big banks and offers a strategic advantage for retail traders.

The Pitfall of Novice Traders

A prevalent mistake among novice traders is selling in a bullish long-term market. This counterintuitive behavior stems from conditioning by mentors who advocate buying after an uptrend and selling after a downtrend. Such a strategy contradicts the trading psychology of major financial institutions, revealing a fundamental flaw in the approach taught to retail traders.

The Top-Down Analysis Approach

To address this issue, a top-down analysis approach is recommended. Unlike the bottom-up approach favored by many, starting the analysis from a broader perspective provides more reliable cues for market direction. Recognizing that the bigger picture holds the key to understanding market movements, this methodology aligns more closely with the trading strategies employed by major financial institutions.

Anticipating Market Movements: A Case Study

An illustrative example of the effectiveness of this approach is evident in the analysis conducted at the beginning of August 2021. By employing order flow analysis, the trader identified key locations where major banks had previously traded, leaving behind unfilled buy orders. Recognizing these locations as magnets for price, the trader accurately predicted the continuation of a temporary downtrend in August. The skillful execution of this strategy allowed the trader to catch the low of August 2021, demonstrating the value of thinking and trading like a bank.

Beyond Market Structure: Unveiling the 29%

Success in order flow trading extends beyond the conventional understanding of market structure, which only constitutes 29% of the analysis. Identifying the Relevant Bid and Demand (RBD) zones in the market becomes crucial. However, not all RBDs present equal trading opportunities. The key lies in selecting the RBD located at the right position, strategically distant from opposing zones, to ensure a low-risk trading opportunity.

Parting Thoughts: Cultivating Success in Forex Trading

In a departure from conventional practices, this alternative approach to Forex trading emphasizes market turning points, aligning with the psychology and strategies employed by major financial institutions. The emphasis on low-risk, high-reward trading at specific locations, backed by order flow analysis, offers retail traders a unique advantage. As a call to action, the conclusion prompts readers to provide their email addresses for further updates, hinting at a commitment to ongoing education and a promise of safe and secure course materials delivered via a MEGA download link.