Description

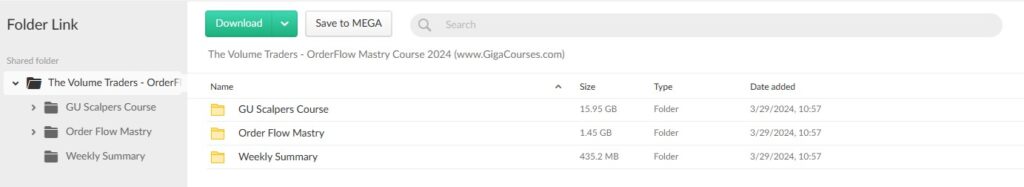

Download Proof | The Volume Traders – OrderFlow Mastry Course 2024(17.83 GB)

![]()

The Volume Traders – OrderFlow Mastry Course 2024

Introduction to Volume Trading

In the ever-evolving landscape of financial markets, mastering trading strategies is essential for success. Among these strategies, volume trading stands out as a fundamental approach, relying on the analysis of trading volume to make informed decisions. The Volume Traders – OrderFlow Mastery Course 2024 offers a comprehensive guide to understanding and leveraging volume data for profitable trading.

Understanding Order Flow Dynamics

At the core of volume trading lies the concept of order flow, which refers to the process of incoming buy and sell orders in the market. The course delves deep into understanding order flow dynamics, including the impact of large institutional orders, market sentiment, and liquidity levels on price movements. By dissecting order flow data, traders gain valuable insights into market trends and potential trading opportunities.

Interpreting Volume Profiles

One key aspect covered in the course is volume profiling, a technique used to analyze volume distribution at different price levels. Traders learn to interpret volume profiles to identify areas of high trading activity, such as support and resistance zones. Through hands-on exercises and real-world examples, participants develop the skills to incorporate volume profiles into their trading strategies effectively.

Utilizing Volume Spread Analysis

Volume spread analysis (VSA) is another powerful tool explored in the course, focusing on the relationship between volume, price, and spread fluctuations. Traders are taught to recognize patterns and anomalies in volume spread to anticipate price movements with greater accuracy. By mastering VSA techniques, participants gain a competitive edge in predicting market reversals and breakouts.

Implementing Volume-Based Indicators

The course introduces a range of volume-based indicators designed to enhance trading decision-making. From simple metrics like volume bars and cumulative volume delta to advanced indicators such as volume-weighted average price (VWAP) and volume oscillator, traders learn to leverage these tools effectively in different market conditions. Through practical demonstrations, participants gain proficiency in customizing and fine-tuning volume-based indicators to suit their trading styles.

Developing Trading Strategies

Building on the foundation of volume analysis, the course guides traders in developing robust trading strategies tailored to their risk tolerance and objectives. Participants learn to integrate volume insights with technical analysis methods such as candlestick patterns, trend lines, and moving averages to confirm trade signals effectively. By backtesting strategies and optimizing parameters, traders refine their approaches for consistent profitability.

Risk Management and Psychology

Recognizing the importance of risk management and psychological discipline, the course emphasizes strategies for preserving capital and maintaining emotional balance during trading. Through case studies and interactive discussions, participants learn to set realistic goals, manage position sizing, and control impulsive behavior. By cultivating a disciplined mindset and adhering to sound risk management principles, traders increase their resilience to market fluctuations.

Advanced Order Flow Techniques

In the final stages of the course, participants explore advanced order flow techniques, including footprint charts, depth of market (DOM) analysis, and order book dynamics. Through live market simulations and in-depth case studies, traders gain a deeper understanding of market microstructure and the intricacies of order flow interpretation. Armed with advanced order flow insights, participants are equipped to navigate complex market environments with confidence.

Conclusion: Mastering Volume Trading

The Volume Traders – OrderFlow Mastery Course 2024 equips traders with the knowledge, skills, and tools needed to excel in volume trading. By understanding order flow dynamics, interpreting volume profiles, and implementing advanced volume-based strategies, participants gain a competitive edge in today’s dynamic markets. With a focus on risk management and psychological discipline, traders are empowered to make informed decisions and achieve long-term success in their trading endeavors.