Description

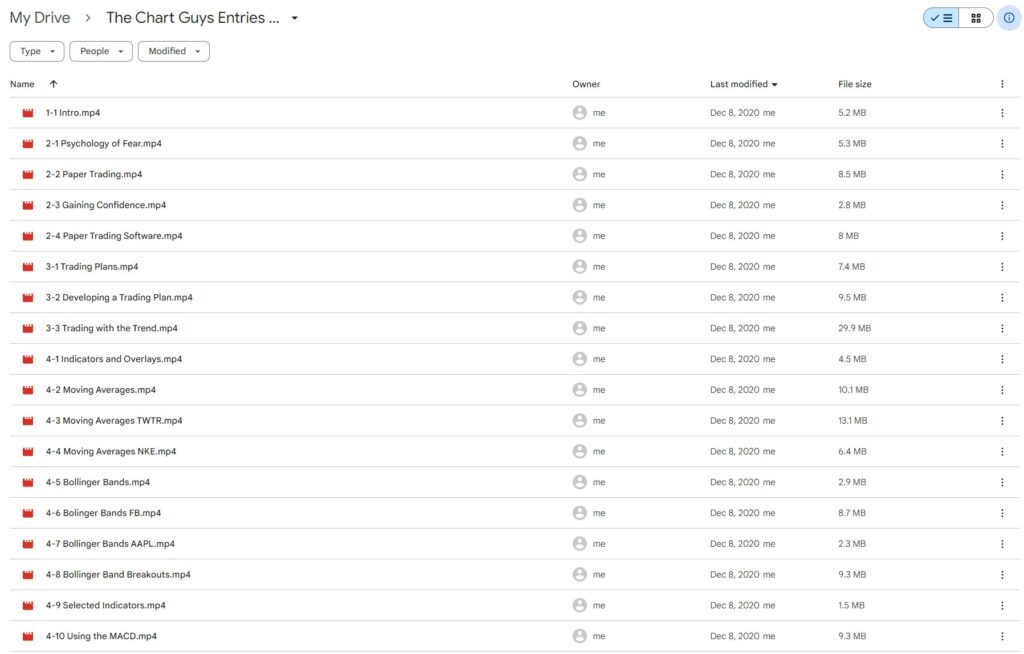

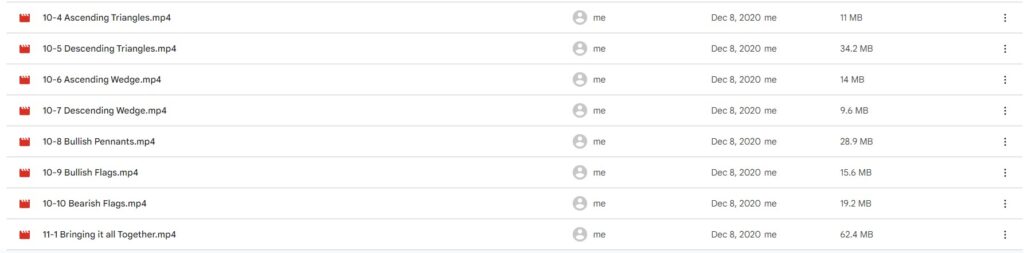

Download Proof | The Chart Guys Entries and Exit Strategy (982 MB)

![]()

The Chart Guys Entries and Exit Strategy

The Chart Guys is a popular trading community and educational platform known for its emphasis on technical analysis and disciplined trading strategies. Their approach to entries and exits revolves around the interpretation of price charts, volume, and various technical indicators to identify high-probability trading opportunities while managing risk effectively. Here’s an overview of their entry and exit strategies:

- Technical Analysis: The Chart Guys primarily rely on technical analysis to make trading decisions. This involves studying price charts, patterns, trends, support and resistance levels, and various technical indicators such as moving averages, Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), and Bollinger Bands, among others.

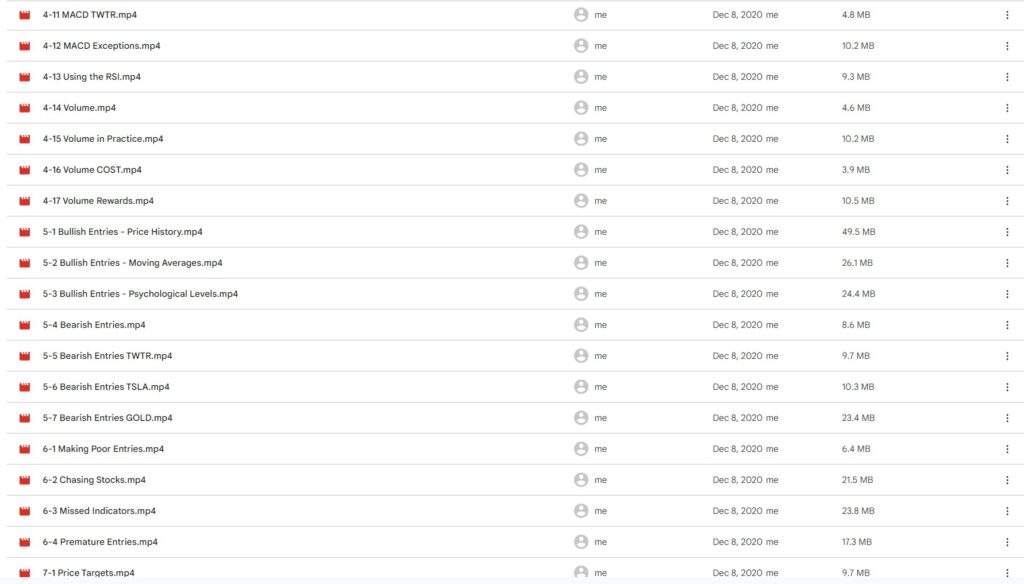

- Identifying Trends: Before entering a trade, The Chart Guys look for clear trends in the price action of the asset they’re interested in. They may use trendlines or moving averages to confirm the direction of the trend. In an uptrend, they seek opportunities to buy, while in a downtrend, they look for opportunities to sell short or exit long positions.

- Confirmation Signals: Once a potential trading opportunity is identified, The Chart Guys wait for confirmation signals to enter the trade. These signals could come from a combination of technical indicators aligning with the direction of the trend, or from the price action itself, such as a breakout above a key resistance level or a bounce off a support level.

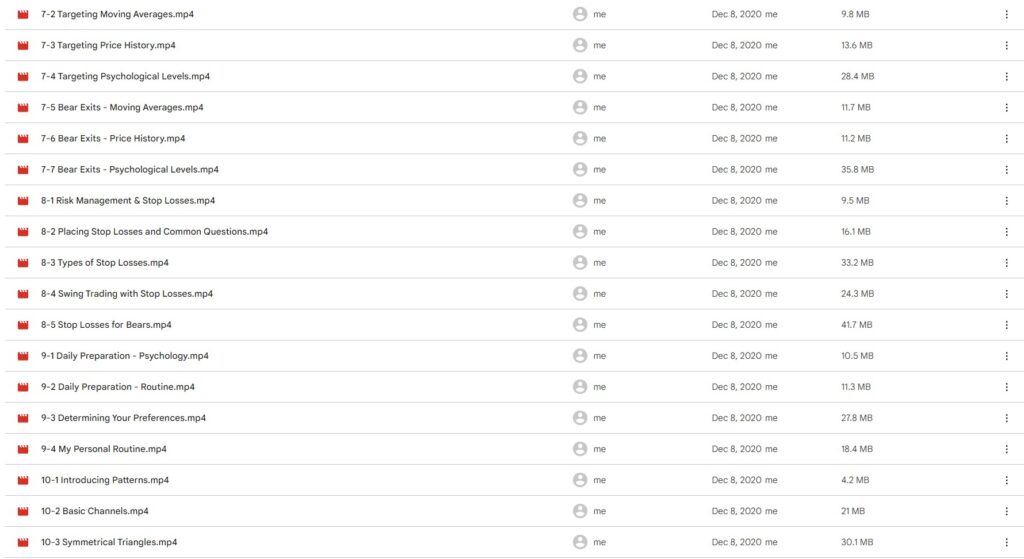

- Risk Management: Managing risk is paramount for The Chart Guys. They typically set stop-loss orders to limit potential losses on trades. Stop-loss orders are placed at strategic levels below support (for long positions) or above resistance (for short positions) to exit the trade if the price moves against them beyond a certain threshold.

- Profit Targets: The Chart Guys also have predefined profit targets based on the potential reward-to-risk ratio of the trade. These targets are often set at key levels of resistance (for long positions) or support (for short positions) where they anticipate the price may encounter obstacles or reverse direction.

- Trailing Stops: In some cases, The Chart Guys employ trailing stops to lock in profits as the trade moves in their favor. A trailing stop is adjusted periodically to follow the price action, allowing them to capture additional gains while still protecting against potential reversals.

- Exit Strategies: The Chart Guys use a combination of technical signals and predefined criteria to determine when to exit a trade. This could include reaching a profit target, hitting a stop-loss level, or the appearance of reversal signals on the charts indicating that the trend may be losing momentum.

Overall, The Chart Guys’ entry and exit strategy is based on a systematic approach to technical analysis, risk management, and disciplined execution, aimed at maximizing profits while minimizing losses in the unpredictable world of trading.

View More Courses : Click Here

Become a member at : Click Here