Description

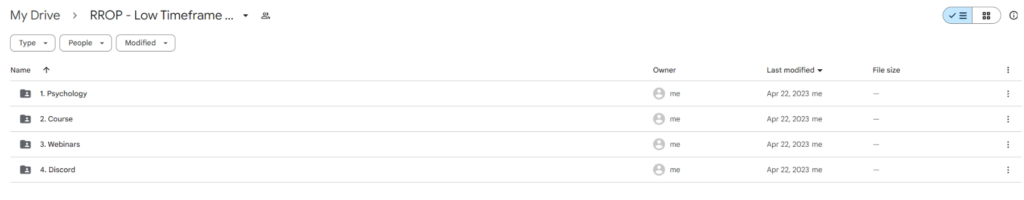

Download Proof | RROP – Low Timeframe Supply & Demand (10.4 GB)

![]()

RROP – Low Timeframe Supply & Demand

Introduction: Understanding and effectively applying the concept of supply and demand is crucial in navigating the complexities of financial markets. In the realm of trading, particularly on low timeframes, the principles of supply and demand play a pivotal role. Rapid Rate of Price (RROP) movements on lower timeframes demand a nuanced approach to identifying and trading within supply and demand zones.

Low Timeframe Dynamics: Low timeframes, such as the 1-hour or 15-minute charts, exhibit heightened volatility and rapid price changes. Traders operating in this domain must adapt their strategies to the faster pace of market movements. Traditional supply and demand zones, while still relevant, require refinement to cater to the unique dynamics of low timeframes.

Identification of Supply and Demand Zones: The first step in navigating low timeframe supply and demand is precise zone identification. Supply zones represent areas where selling interest surpasses buying pressure, leading to potential reversals. Conversely, demand zones indicate regions where buying interest exceeds selling pressure, potentially causing price bounces or reversals. In low timeframes, these zones may be more fleeting, demanding keen observation and quick decision-making.

Rapid Rate of Price (RROP) Movements: Low timeframes often witness RROP movements, characterized by swift and unpredictable price changes. This necessitates a refined approach to identifying zones, as traditional static zones may not capture the rapid shifts in supply and demand. Traders must incorporate volatility into their analysis, adjusting the size and placement of zones to align with the accelerated pace of the market.

Dynamic Nature of Low Timeframe Zones: Unlike higher timeframes, where zones may remain relevant for extended periods, low timeframe supply and demand zones are transient. Traders must recognize the dynamic nature of these zones, adapting their strategies to accommodate the ever-changing market conditions. Regular reassessment of zones based on recent price action is essential for staying ahead of the curve.

Risk Management in Low Timeframe Trading: Given the increased volatility on lower timeframes, effective risk management becomes paramount. Traders must set tight stop-loss orders to mitigate potential losses during sudden and adverse price movements. Additionally, proper position sizing and leverage management are crucial to ensure that a series of rapid trades do not lead to significant capital depletion.

Incorporating Technical Indicators: To enhance the precision of low timeframe supply and demand analysis, traders often complement their approach with technical indicators. Oscillators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can provide valuable insights into overbought or oversold conditions, aligning with potential supply or demand zones.

Adaptability and Flexibility: Successful navigation of low timeframe supply and demand necessitates a high degree of adaptability and flexibility. Traders must be open to adjusting their strategies based on evolving market conditions. This may involve modifying zone parameters, incorporating additional indicators, or swiftly reassessing the overall trading plan.

Conclusion: In the realm of low timeframe supply and demand, traders face the challenge of navigating a rapidly changing landscape. The identification and utilization of dynamic zones, coupled with effective risk management and adaptability, are key to thriving in this environment. By acknowledging the unique characteristics of RROP movements and embracing a strategic approach, traders can enhance their ability to capitalize on opportunities in low timeframe trading.