Description

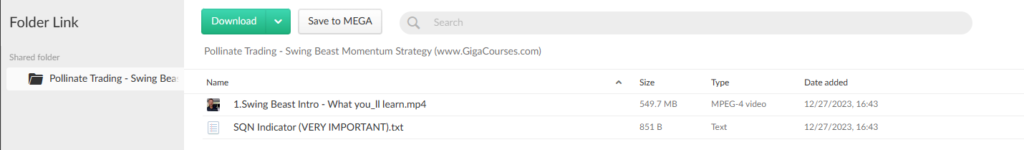

Download Proof | Pollinate Trading – Swing Beast Momentum Strategy (549.7 MB)

![]()

Pollinate Trading – Swing Beast Momentum Strategy

Introduction: Pollinate Trading’s Swing Beast Momentum Strategy is a powerful approach to navigating the dynamic landscape of financial markets. This strategy combines elements of swing trading and momentum investing, creating a unique and effective method for capitalizing on market trends. The Swing Beast Momentum Strategy is designed to identify and exploit short to medium-term opportunities, offering traders a systematic and disciplined approach to achieving consistent profits.

Key Principles: Swing Trading Precision: The strategy hinges on the precise timing of market entries and exits. Traders using the Swing Beast Momentum Strategy aim to capture “swings” in asset prices, profiting from short to medium-term price movements. This precision is achieved through careful analysis of technical indicators, chart patterns, and market sentiment.

Momentum Investing Dynamics: The strategy also incorporates momentum investing principles to ride the wave of strong, sustained price movements. By identifying assets with strong momentum, traders can align themselves with the prevailing market sentiment and capitalize on extended price trends. This dynamic approach enables traders to extract maximum gains from trending markets.

Technical Analysis Framework: Indicators and Oscillators: The Swing Beast Momentum Strategy employs a robust set of technical indicators and oscillators to analyze price charts. Moving averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence) are among the key tools used to identify potential entry and exit points. These indicators help traders pinpoint optimal times to initiate trades and assess the strength of price movements.

Candlestick Patterns: Candlestick patterns play a crucial role in the strategy, providing valuable insights into market psychology. Traders using this strategy pay close attention to reversal patterns, such as engulfing patterns and doji candles, to anticipate potential trend changes. These candlestick signals enhance the overall accuracy of the strategy and contribute to informed decision-making.

Risk Management: Position Sizing: A fundamental aspect of the Swing Beast Momentum Strategy is effective risk management through proper position sizing. Traders carefully allocate capital based on the perceived risk of each trade, ensuring that no single position jeopardizes the overall portfolio. This approach safeguards against substantial losses and promotes consistent, sustainable growth.

Stop-loss Orders: The strategy relies on strategically placed stop-loss orders to limit potential losses. Traders set these orders at predefined levels, aligning with their risk tolerance and market analysis. By incorporating stop-losses into the trading plan, the strategy minimizes downside exposure and protects capital during adverse market conditions.

Execution and Monitoring: Trade Execution: The Swing Beast Momentum Strategy emphasizes disciplined execution based on predetermined criteria. Traders enter positions only when specific technical conditions are met, ensuring a systematic and rule-based approach to trading. This discipline is crucial for maintaining consistency and avoiding impulsive decisions driven by emotions.

Continuous Monitoring: Successful implementation of the strategy requires continuous monitoring of both individual trades and overall market conditions. Traders stay vigilant for any signs of changing market dynamics or emerging patterns that could impact their positions. Regular reviews and adjustments are made to adapt to evolving market trends.

Conclusion: Pollinate Trading’s Swing Beast Momentum Strategy provides traders with a well-defined framework to navigate the complexities of financial markets. By combining the precision of swing trading with the dynamics of momentum investing, this strategy offers a comprehensive approach to capturing short to medium-term opportunities. With a focus on technical analysis, risk management, and disciplined execution, the Swing Beast Momentum Strategy empowers traders to make informed decisions and achieve consistent profitability in the ever-changing world of trading.