Description

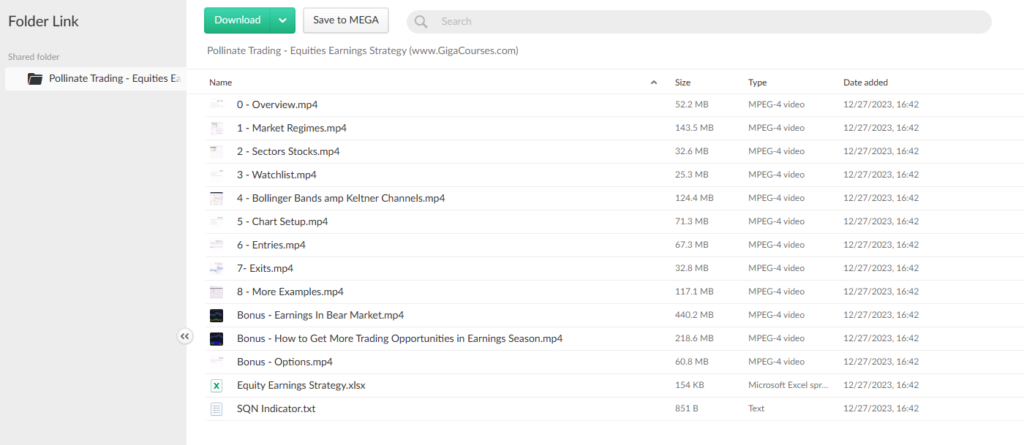

Download Proof | Pollinate Trading – Equities Earnings Strategy (1.35 GB)

![]()

Pollinate Trading – Equities Earnings Strategy

Introduction: Pollinate Trading’s Equities Earnings Strategy is a comprehensive approach designed to capitalize on opportunities in the equities market during earnings seasons. This strategy is tailored for traders and investors aiming to navigate the volatility associated with corporate earnings reports. By combining fundamental analysis with technical indicators, Pollinate Trading offers a strategic framework that aims to optimize decision-making and maximize returns.

Fundamental Analysis: At the core of Pollinate Trading’s Equities Earnings Strategy lies a robust fundamental analysis process. This involves a meticulous examination of a company’s financial health, including revenue, earnings per share (EPS), and key performance indicators. Traders utilizing this strategy gain insights into a company’s potential for growth and profitability. The goal is to identify stocks with strong fundamentals, increasing the probability of positive earnings surprises or exceeding market expectations.

Earnings Calendar Utilization: An integral aspect of the strategy involves leveraging the earnings calendar. Pollinate Trading emphasizes the importance of staying informed about upcoming earnings reports. By strategically planning trades around these events, traders can take advantage of heightened volatility and capitalize on price movements triggered by earnings announcements. This tactical use of the earnings calendar is designed to enhance risk management and increase the likelihood of profitable trades.

Technical Indicators for Timing: In conjunction with fundamental analysis, Pollinate Trading incorporates technical indicators to refine entry and exit points. The Equities Earnings Strategy employs tools such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to gauge price momentum and potential reversals. These technical indicators assist traders in making well-timed decisions, aligning their trades with both fundamental developments and market sentiment during earnings seasons.

Options Strategies for Risk Management: Recognizing the inherent volatility during earnings seasons, Pollinate Trading integrates options strategies as a risk management tool. Traders can employ options to hedge against potential downside risks or amplify returns on bullish expectations. By incorporating various options strategies, such as straddles or strangles, participants in this strategy aim to navigate earnings-related price fluctuations with a risk-conscious approach.

Sector and Industry Analysis: Pollinate Trading’s Equities Earnings Strategy extends beyond individual stock analysis to include a broader examination of sectors and industries. Understanding the macroeconomic factors influencing specific sectors allows traders to identify trends and correlations. This broader perspective enhances the ability to make informed decisions based on both micro and macro-level market dynamics during earnings seasons.

Continuous Learning and Adaptation: A distinctive feature of this strategy is its emphasis on continuous learning and adaptation. Pollinate Trading recognizes the dynamic nature of the equities market and the ever-evolving landscape of earnings-related events. Traders are encouraged to stay informed about market developments, refine their strategies based on performance feedback, and adapt to changing market conditions. This commitment to ongoing improvement positions traders to navigate future earnings seasons with agility and effectiveness.

Conclusion: In conclusion, Pollinate Trading’s Equities Earnings Strategy offers a comprehensive framework for traders and investors seeking to capitalize on opportunities during earnings seasons. By combining fundamental analysis, strategic use of the earnings calendar, technical indicators, options strategies, and a broader sectoral perspective, this strategy provides a holistic approach to navigating the intricacies of the equities market. With a focus on continuous learning and adaptation, participants are equipped to make informed decisions and optimize their trading performance in the dynamic landscape of earnings-driven market movements.