Description

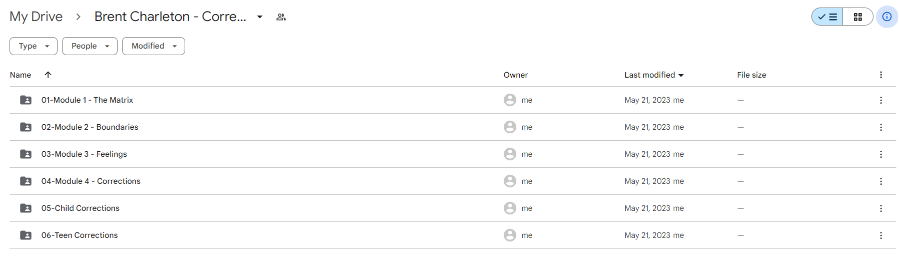

Download Proof | Brent Charleton – Correction Method (49.9 GB)

![]()

Brent Charleton – Correction Method

Introduction: The Brent Charleton Correction Method is a distinguished approach in the field of financial analysis, developed by industry expert Brent Charleton. Recognizing the importance of accurate data and precise corrections in financial modeling, Charleton’s method addresses common pitfalls in financial analysis, providing practitioners with a systematic approach to enhance the accuracy of their models.

Key Principles of the Correction Method: At the core of the Brent Charleton Correction Method are key principles that underscore the importance of meticulous corrections. The method emphasizes the need for a thorough understanding of financial data sources, scrutiny of assumptions, and proactive identification and rectification of errors. By adhering to these principles, practitioners can significantly enhance the reliability of their financial models.

Data Source Scrutiny: A critical aspect of the Correction Method is the scrutiny of data sources. Charleton highlights the necessity of verifying the accuracy and reliability of data inputs before incorporating them into financial models. This includes evaluating the credibility of sources, cross-referencing data points, and ensuring consistency across datasets. Rigorous scrutiny at this stage forms the foundation for accurate financial analysis.

Assumption Review and Validation: Assumptions play a pivotal role in financial modeling, and the Correction Method advocates for a comprehensive review and validation process. Practitioners are encouraged to revisit assumptions regularly, considering changes in market conditions, economic factors, or industry dynamics. By maintaining up-to-date and validated assumptions, analysts can prevent errors and inaccuracies from propagating through the model.

Proactive Error Identification and Rectification: Rather than relying solely on post hoc error detection, the Correction Method promotes a proactive approach to error identification and rectification. This involves implementing robust checks and balances within the modeling process to catch potential errors in real-time. By integrating automated checks and thorough reviews at each stage, practitioners can detect and rectify errors before they compromise the integrity of the financial model.

Continuous Model Testing and Validation: The Correction Method advocates for continuous model testing and validation as an ongoing practice. This includes stress testing the model under various scenarios, comparing outputs with historical data, and validating results against independent benchmarks. Regular testing ensures that the model remains accurate and reliable, even as external factors evolve.

Documentation and Transparency: Documentation and transparency are integral components of the Correction Method. Practitioners are encouraged to maintain clear and detailed documentation of the modeling process, including data sources, assumptions, and methodologies. Transparent documentation not only aids in error traceability but also facilitates collaboration and knowledge sharing within the financial analysis team.

Implementation of Technology Solutions: Recognizing the role of technology in modern financial analysis, the Correction Method supports the implementation of advanced technology solutions. Automation tools, machine learning algorithms, and error-checking software can be leveraged to streamline the correction process, reduce manual errors, and enhance the overall efficiency of financial modeling.

Conclusion: In conclusion, the Brent Charleton Correction Method stands as a valuable contribution to the field of financial analysis, offering a systematic and proactive approach to enhancing the accuracy of financial models. By emphasizing data source scrutiny, assumption validation, proactive error identification, continuous testing, documentation, and the implementation of technology solutions, Charleton provides practitioners with a comprehensive framework to ensure the integrity and reliability of their financial analyses. Adopting the principles of the Correction Method can lead to more accurate and trustworthy financial models, ultimately contributing to informed decision-making in the financial realm.