Description

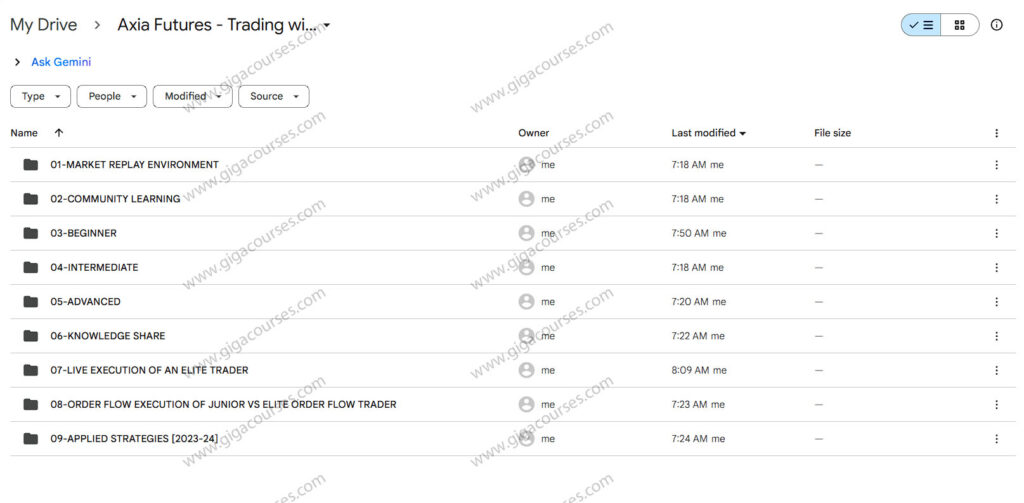

Download Proof | Axia Futures – Trading with Price Ladder and Order Flow Strategies 2024 (21.3 GB)

![]()

Axia Futures – Trading with Price Ladder and Order Flow Strategies 2024

Axia Futures’ Trading with Price Ladder and Order Flow Strategies 2024 is a cutting-edge training program designed for traders seeking to master the art of real-time order flow analysis through the DOM (Depth of Market) and price ladder. With structured progression from beginner to advanced, and an immersive Market Replay Environment, this course provides a practical and professional framework for becoming an elite order flow trader.

Market Replay Environment & Community Learning

Before diving into the modules, the course introduces an immersive Market Replay Environment—a critical feature that allows traders to simulate real market conditions, refine execution, and practice strategies. This hands-on approach mimics professional prop firm training.

Additionally, Axia emphasizes community learning. Participants are encouraged to upload their own order flow videos, analyze peers’ trades, and discuss real executions—creating an interactive, trader-led feedback loop that reinforces learning.

Beginner Level: Foundation of Order Flow Trading

Modules 1–4: Learning the Basics

- Module 1 outlines learning objectives and methodology.

- Module 2 introduces order flow—what it is and why it matters.

- Module 3 presents the roadmap, laying out the path from novice to elite.

- Module 4 emphasizes what the price ladder reveals that traditional charts don’t—offering unique insight into hidden market activity and trader intent.

These modules build essential literacy in reading the tape and understanding market behavior from the inside out.

Intermediate Level: Order Flow in Action

Modules 5–10: Deep Dive into Market Mechanics

- Module 5 covers market participants, algorithms, and high-frequency trading (HFT).

- Module 6 teaches auction dynamics and velocity.

- Module 7 introduces key order flow price patterns.

- Modules 8–10 explore large orders, absorption, spoofing, market flipping, and layering, each supported by quizzes to reinforce retention.

These lessons provide traders with a toolkit to recognize recurring behaviors and decode high-probability setups.

Advanced Level: Elite Execution Strategies

Modules 11–13: Strategic Trade Execution

- Module 11 explains the Trend Reversal Indicator, a visual cue based on order flow pressure.

- Module 12 dives into Momentum Breakout Patterns using real DOM dynamics.

- Module 13 ties it all together—offering practice on the confluence of multiple strategies in different contexts.

These modules are designed to sharpen execution accuracy and timing for experienced traders aiming for professional-level precision.

Knowledge Share & Professional Insights

Modules 14–16: Trader Development & Interviews

- Module 14 looks at the evolution of order flow patterns.

- Module 15 outlines traits of elite traders.

- Module 16 features interviews with elite order flow traders sharing real insights into decision-making and performance under pressure.

This portion helps bridge technical mastery with trader psychology and professional development.

Applied Strategies (2023/24)

The course also includes a dedicated section with real-world strategy drills, such as:

- Volume Stop Hit and Run

- Front Run and Absorption Reversal

- Delta Punch

- Order Book Sweep

- Stops Scalp Continuation

- Data Pullback Continuation

These applied strategies blend tape reading with structured trade plans, offering actionable tactics for different market conditions.

Live Execution Case Studies

Two detailed studies provide unmatched transparency:

- Live Execution of an Elite Trader shows how an expert reads and reacts to DOM in real-time.

- Junior vs Elite Trader Execution compares decision-making, timing, and emotional discipline—making the learning curve concrete and relatable.

Bonuses and Additional Learning

Bonuses include Advanced Replay Drills, central bank commentary trading, and continued community video sharing for ongoing improvement and accountability.

Conclusion

Trading with Price Ladder and Order Flow Strategies 2024 by Axia Futures is not just a course—it’s a complete training ecosystem that blends professional-grade theory, live execution, replay drills, and community support. It’s ideal for serious traders who want to develop an edge by mastering the mechanics and psychology of live order flow trading.