Description

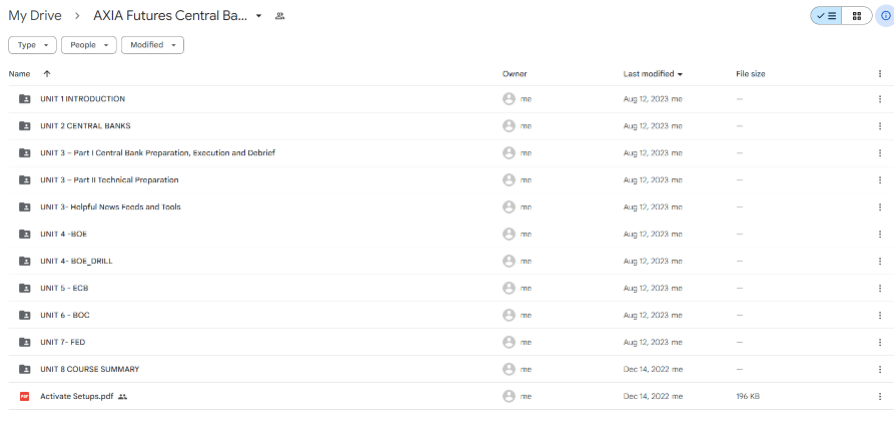

Download Proof | AXIA Futures Central Bank Trading Strategies (5.40 GB)

![]()

AXIA Futures Central Bank Trading Strategies

Introduction: AXIA Futures, a renowned name in trading education, presents a cutting-edge program titled “Central Bank Trading Strategies.” This specialized course unveils insights into navigating the complexities of financial markets, specifically focusing on the impact of central bank decisions. For traders seeking a comprehensive understanding of central bank-driven dynamics, AXIA Futures offers a strategic and informative learning experience.

Strategies Rooted in Central Bank Decisions: The core of this course lies in elucidating strategies that align with and capitalize on central bank decisions. Central banks play a pivotal role in shaping global economies, and understanding their policies is essential for any trader looking to gain an edge in the markets. AXIA Futures delves into strategies crafted around interest rate decisions, monetary policy shifts, and the nuanced language embedded in central bank communications.

Macro-Fundamental Analysis: AXIA Futures emphasizes macro-fundamental analysis as a cornerstone of effective central bank trading strategies. Participants are guided through the intricacies of analyzing economic indicators, inflation rates, and employment data – factors that central banks closely monitor. This macroeconomic understanding forms the basis for anticipating central bank actions and their subsequent impact on various asset classes.

Real-Time Application and Case Studies: The course goes beyond theoretical frameworks by incorporating real-time application and case studies. Participants witness the practical implementation of central bank trading strategies through live demonstrations and analyses of historical scenarios. This hands-on approach ensures that the strategies taught are not only theoretically sound but also applicable in dynamic, real-world trading environments.

Risk Management in Central Bank-Driven Markets: AXIA Futures recognizes the heightened volatility often associated with central bank-driven events. As such, the course places a strong emphasis on risk management strategies tailored to navigate the uncertainties presented by sudden policy shifts or unexpected central bank pronouncements. Participants learn to safeguard their positions and optimize risk-reward ratios in the face of market turbulence.

Quantitative Tools and Technology Integration: Incorporating a modern approach, AXIA Futures integrates quantitative tools and technology into the course. Participants gain insights into leveraging algorithms, data analytics, and technological advancements to enhance the precision and efficiency of their central bank trading strategies. The course equips traders with the skills to adapt to the evolving landscape of algorithmic trading in central bank-influenced markets.

Interactive Learning Environment: AXIA Futures fosters an interactive learning environment, offering participants opportunities for live Q&A sessions, discussions, and feedback. This ensures a collaborative and engaging experience, allowing traders to clarify doubts, share insights, and build a supportive community of learners focused on mastering central bank trading strategies.

Conclusion: In conclusion, AXIA Futures’ “Central Bank Trading Strategies” course stands as a valuable resource for traders aspiring to navigate the intricacies of financial markets influenced by central bank decisions. By providing strategic insights, emphasizing macro-fundamental analysis, integrating risk management principles, and incorporating cutting-edge technology, AXIA Futures empowers traders to approach central bank-driven events with confidence and proficiency. For those seeking a competitive edge in their trading journey, this course serves as a beacon for mastering the art of trading in the realm of central bank dynamics.