Description

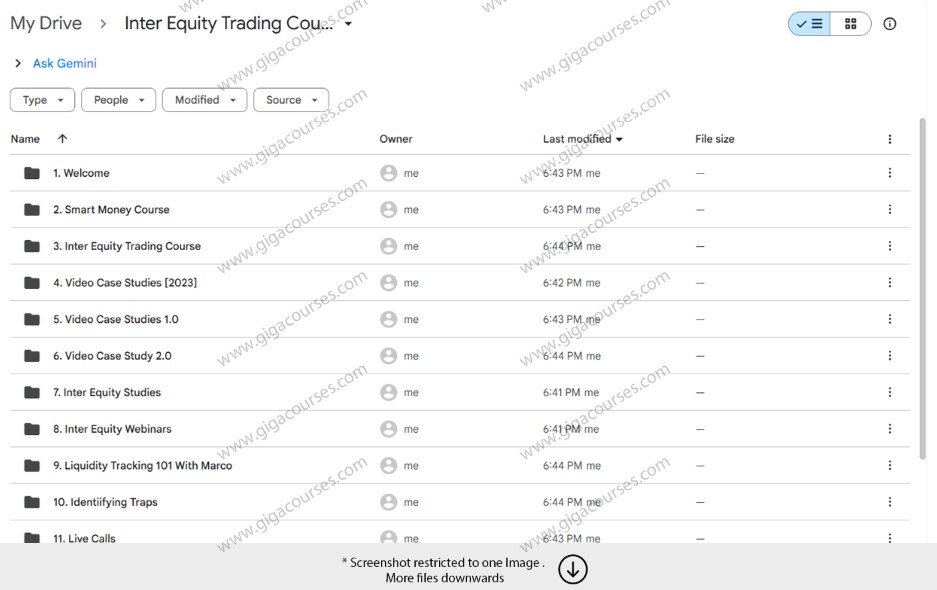

Download Proof | Inter Equity Trading Course (8.49 gb)

![]()

Inter Equity Trading Course – Course Review

The Inter Equity Trading Course is designed for individuals who want to gain a solid foundation in equity trading and understand the principles of the stock market. Whether you are a beginner looking to enter the world of trading or an intermediate trader aiming to refine your strategies, this course provides structured guidance, practical tools, and insights into how equity markets function.

Course Structure and Content

The Inter Equity Trading Course is divided into modules that cover the fundamentals of equity markets, technical and fundamental analysis, trading psychology, and risk management. Learners are introduced to how stock exchanges operate, the role of equity instruments, and the mechanics of buying and selling shares.

A significant part of the course emphasizes technical analysis, including chart reading, candlestick patterns, support and resistance levels, and momentum indicators. Alongside this, the fundamental analysis section guides students in evaluating companies based on earnings, financial reports, and market performance. This dual approach ensures that traders are equipped to make well-informed decisions rather than relying solely on speculation.

Practical Learning Approach

One of the highlights of the Inter Equity Trading Course is its practical learning methodology. Instead of relying only on theory, the course includes live demonstrations, market case studies, and simulation exercises. Students are encouraged to practice strategies in real market conditions, which bridges the gap between knowledge and execution.

Additionally, the course incorporates insights into trading psychology, teaching learners how to manage emotions such as fear and greed that often influence decision-making. By mastering discipline and consistency, traders can improve their long-term success rate.

Key Benefits of the Course

-

Comprehensive Coverage – The course covers everything from basics to advanced strategies, making it suitable for all levels.

-

Risk Management Focus – Students learn how to minimize losses through stop-loss techniques, position sizing, and diversification.

-

Practical Application – Real-life examples and exercises prepare learners for actual market trading.

-

Enhanced Confidence – By the end of the course, participants gain the confidence to analyze equities independently and execute trades effectively.

Who Should Enroll

The Inter Equity Trading Course is ideal for:

-

Beginners who want to understand how equity markets work.

-

Aspiring traders looking for structured knowledge.

-

Investors who want to strengthen their analytical skills.

-

Anyone interested in developing long-term wealth through equity investments.

Pros and Cons

Pros:

-

Clear and structured curriculum.

-

Balanced approach between theory and practice.

-

Emphasis on both technical and fundamental analysis.

-

Focus on trading psychology and risk management.

Cons:

-

May feel overwhelming for absolute beginners without prior financial knowledge.

-

Requires consistent practice outside the course for mastery.

Conclusion

The Inter Equity Trading Course stands out as a comprehensive and practical program for anyone serious about entering the equity markets. With its structured modules, emphasis on risk management, and practical demonstrations, it equips learners with the necessary skills to make informed and profitable trading decisions. While it demands dedication and consistent practice, the knowledge gained can serve as a strong foundation for a successful trading journey.

For individuals looking to build confidence, enhance market understanding, and develop disciplined trading habits, the Inter Equity Trading Course is a highly valuable investment in financial education.